Toner Pad Market Growth: Trends, Drivers, and Regional Leadership

Global Skincare Device Market Expansion Fueled by Toner Pad Adoption

Market analysts expect the worldwide skincare device sector to expand at around 12.3 percent annually until 2028, and toner pads are playing a big role in this growth. These little pads offer something special because they're easy to carry around, apply exactly where needed, and work well with all sorts of active ingredients. This fits perfectly with what people want these days - quick, effective home treatments without spending hours on skincare rituals. Urban workers who barely have time for lunch breaks and those mixing salon visits with home care routines find them particularly useful. After the pandemic hit in 2020, interest in toner pads jumped by nearly 30 percent, making them part of everyday beauty routines as well as high-end treatment plans. Now, these convenient, ready-to-use pads account for more than 40% of all sales in skin care delivery systems globally, showing just how much the market has shifted toward practical solutions that fit into busy lifestyles.

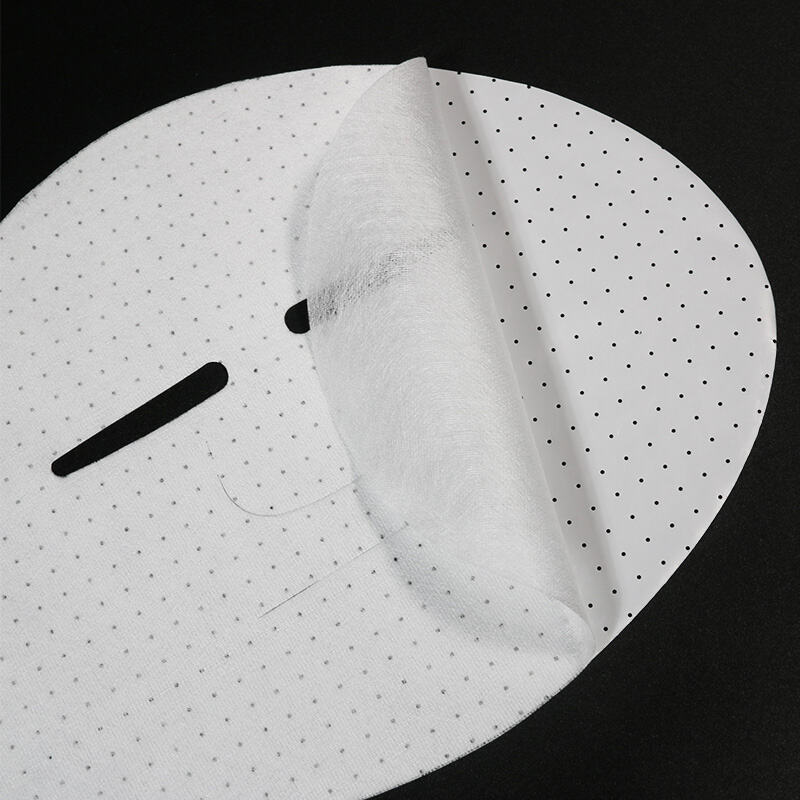

Asia-Pacific as the Innovation Hub: South Korea and Japan Lead Toner Pad Development

The Asia-Pacific region has become ground zero for toner pad innovation, responsible for around 67% of all patents filed worldwide last year. South Korean research facilities are really pushing boundaries with their work on bio-cellulose materials that can soak up three times what regular cotton manages. Meanwhile across the sea in Japan, companies are developing biodegradable hydrogel bases that meet strict environmental standards. People in this part of the world tend to embrace new products quickly too, with nearly nine out of ten willing to try something fresh off the production line. This eagerness creates a powerful feedback mechanism that cuts down product development time to about five to seven months instead of the usual twelve month grind seen elsewhere. As a result, APAC continues to serve as the primary testing ground where tomorrow's toner pads get born today.

Toner Pad Profitability: High-Margin Economics and Recurring Revenue Models

Unit Economics: COGS vs. Retail Markup (400–600% Gross Margin Typical)

The economics behind toner pads are pretty impressive actually. Most manufacturers spend around ten to thirty cents making each one, yet they can sell them at stores for fifty cents all the way up to nearly two bucks. That means companies often make four to six times what they spent on materials alone. Why such big profits? Well, first off, the cost of goods sold stays really low. Plus there's this whole perception thing where people think these products are worth paying extra for in the luxury skincare market. And let's not forget about practical stuff too. Toner pads take up so much less space than regular liquid toners when packed or stored. They weigh less during shipping and don't need as much room on store shelves either. According to some recent market research from last year, these kinds of margins beat out typical beauty products by anywhere between 200 and 300 percent. What makes it even better is that as companies produce more units, their costs go down even further. This helps boost profits while still keeping that premium brand image intact.

Subscription and Repurchase Leverage: 68% Repeat Rate Among Premium Korean Beauty Brands

The recurring revenue model is what keeps toner pads profitable over time. Take premium Korean beauty brands for instance they see around 68% of customers coming back again and again, which beats the typical 45% repeat rate across the skincare market. Why? Because these products get used every day and people actually notice their skin getting smoother, clearer, and better hydrated. Subscription services turn this kind of loyal behavior into steady money coming in. Customers who sign up tend to spend about 30% more throughout their relationship with the brand compared to folks who just buy once (Consumer Insights found this in 2024). Smart companies keep their subscribers happy by offering different subscription levels and putting together special packages like combining pads with matching serums or essences. This approach cuts down on how much it costs to find new customers by roughly 18 to 22%, turning those single transactions into something more lasting and built on real relationships rather than just quick sales.

Commercialization Strategies for Toner Pads: Channel Prioritization and D2C Advantage

The direct-to-consumer route gives toner pad brands the best shot at healthy profit margins. We're talking gross margins often over 400%, mainly because there are no middlemen tacking on their markups which typically range from 15 to 30%. Plus, nobody has to pay those hefty slotting fees anymore either, which can run anywhere from $10k to $50k per product line each year. What makes D2C really powerful is the ability to collect first-hand customer data. This information becomes gold when it comes to tailoring products, running effective marketing campaigns, and keeping customers coming back. Still worth noting though, online marketplaces such as Amazon along with specialty stores play important roles too. They help people find out about new brands and build trust in the marketplace. Companies that combine both approaches tend to see better results overall. Research shows these hybrid businesses actually get around 23 percent more value from each customer compared to those sticking solely to direct sales. For maximum effectiveness across different selling points, think about creating specific versions of products suited for each channel. Big family packs work well for online shoppers, compact sizes make sense for drugstore shelves, and exclusive releases create buzz when launching in department stores. This approach keeps things organized and ensures good financial returns throughout all distribution channels.

Navigating Regulatory and Sustainability Challenges in Toner Pad Scaling

EU Cosmetics Regulation (EC No 1223/2009) Implications for Preservative-Free and Biodegradable Toner Pads

The EU Cosmetics Regulation (EC No 1223/2009) sets rigorous benchmarks for toner pad safety, sustainability, and transparency—particularly for preservative-free and biodegradable formulations. Compliance requires:

- Reformulation to replace restricted preservatives with validated natural alternatives, increasing R&D investment by 25–40%;

- OECD 301-certified biodegradability testing, extending development timelines by 6–8 months;

- Full ingredient traceability and Annex I-compliant safety assessments across the supply chain.

The regulations are pushing companies to completely change how they operate. Supply chains are shifting towards certified bamboo fiber and TENCEL materials, while manufacturing facilities need upgrades to stop microbial issues in products without preservatives. Lifecycle assessments have also become standard practice covering everything from where materials come from all the way through to what happens when products reach their end of life. Looking at consumer trends, around 73% of people in Europe now want plastic free packaging and ingredients derived from plants according to Euromonitor data from last year. This means strict regulations aren't just compliance hurdles anymore but actual business opportunities. Sure, getting compliant typically costs about $740,000 upfront as per Ponemon Institute research, but companies that manage to get those green certifications tend to command prices 31% higher than others and move products off shelves 19% quicker. These numbers clearly show that leading on sustainability isn't just good for the planet it actually pays off commercially too.

Hot News

Hot News